The Facts About Stonewell Bookkeeping Revealed

Everything about Stonewell Bookkeeping

Table of ContentsNot known Factual Statements About Stonewell Bookkeeping The Of Stonewell BookkeepingStonewell Bookkeeping Fundamentals ExplainedStonewell Bookkeeping Fundamentals ExplainedThe smart Trick of Stonewell Bookkeeping That Nobody is Talking About

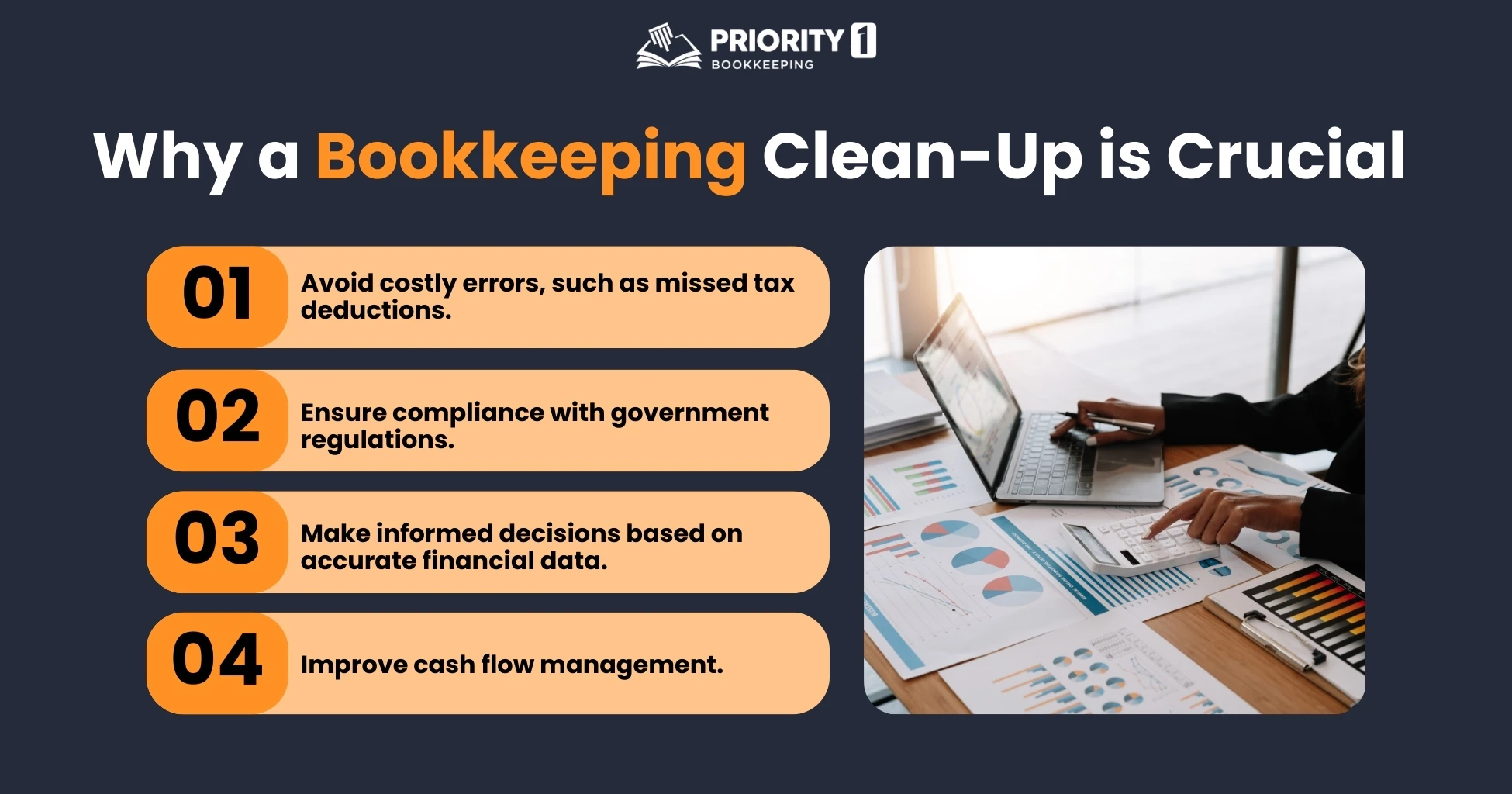

Here, we address the inquiry, exactly how does accounting aid a business? The true state of a company's funds and cash money flow is constantly in change. In a feeling, audit publications represent a snapshot in time, however only if they are upgraded usually. If a business is absorbing little bit, a proprietor must do something about it to boost revenue.

It can also settle whether to enhance its very own settlement from clients or customers. None of these verdicts are made in a vacuum cleaner as factual numerical information need to copyright the financial choices of every tiny organization. Such information is compiled with bookkeeping. Without an intimate expertise of the dynamics of your capital, every slow-paying customer, and quick-invoicing financial institution, becomes a celebration for stress and anxiety, and it can be a tedious and boring task.

You understand the funds that are available and where they drop short. The news is not constantly excellent, yet at the very least you understand it.

The Single Strategy To Use For Stonewell Bookkeeping

The labyrinth of deductions, credits, exemptions, schedules, and, obviously, fines, suffices to simply give up to the internal revenue service, without a body of well-organized documentation to sustain your cases. This is why a devoted accountant is vital to a small organization and is worth his/her king's ransom.

Those charitable contributions are all mentioned and come with by info on the charity and its settlement information. Having this info in order and around lets you file your income tax return easily. Bear in mind, the federal government doesn't mess around when it's time to file taxes. To be certain, an organization can do every little thing right and still go through an internal revenue service audit, as many already recognize.

Your business return makes insurance claims and representations and the audit focuses on confirming them (https://slides.com/hirestonewell). Great accounting is everything about linking the dots between those representations and fact (business tax filing services). When auditors can adhere to the details on a ledger to receipts, financial institution statements, and pay stubs, to name a couple of papers, they promptly discover of the competency and stability of business organization

The Stonewell Bookkeeping PDFs

In the same means, slipshod accounting contributes to anxiety and anxiety, it also blinds local business owner's to the prospective they can realize in the long run. Without the information to see where you are, you are hard-pressed to set a destination. Just with easy to understand, thorough, and factual information can an organization proprietor or monitoring group plot a course for future success.

Entrepreneur understand ideal whether a bookkeeper, accountant, or both, is the appropriate service. Both make important contributions to a company, though they are not the very same career. Whereas a bookkeeper can collect and arrange the information required to support tax obligation preparation, an accountant is much better fit to prepare the return itself and truly evaluate the revenue declaration.

This short article will certainly dive into the, consisting of the and just how it can profit your service. Accounting includes recording and arranging financial transactions, consisting of sales, acquisitions, repayments, and invoices.

By frequently updating economic records, accounting helps businesses. This aids in easily r and saves services from the stress and anxiety of browsing for papers throughout due dates.

The Stonewell Bookkeeping Diaries

They are generally worried about whether their cash has actually been used appropriately or otherwise. They absolutely wish to know if the business is generating income or not. They additionally wish to know what possibility business has. These elements can be conveniently taken care of with accounting. The earnings and loss declaration, which is prepared routinely, shows the profits and right here likewise establishes the potential based on the earnings.

By keeping a close eye on financial records, businesses can establish reasonable objectives and track their progression. Routine bookkeeping makes sure that companies stay compliant and prevent any type of fines or legal concerns.

Single-entry accounting is basic and works best for small companies with couple of transactions. It does not track properties and responsibilities, making it less thorough compared to double-entry bookkeeping.

The Main Principles Of Stonewell Bookkeeping

This could be daily, weekly, or monthly, relying on your service's size and the quantity of deals. Don't be reluctant to seek aid from an accounting professional or accountant if you locate managing your financial documents testing. If you are trying to find a free walkthrough with the Accountancy Option by KPI, contact us today.